There are 1.9 million limited company setups in the UK1. Around 78% of these employ no more than four people.Many will be sole operators employed by their own limited companies and drawing down a salary and dividend as remuneration.

This position allows them to take advantage of a particularly tax-efficient Life Insurance known as Relevant Life Cover. Yet despite this cover being widely available from all of the UK's major insurers, its uptake remains low and not enough directors have heard of it and the benefits it can bring.

Staying Relevant: What is Relevant Life Cover?

Relevant Life Insurance is very similar to the Group Life Insurance that may be offered by a larger company to its employees. However, Group Life Insurance isn't typically available for companies with fewer than four employees. Here, Relevant Life Insurance can step into this gap in the market to cover the directors of the smallest limited companies in the UK.

While the company owns and pays for the premiums, the benefit is paid to the employee's family should the worst happen. This is paid via a relevant life trust set up alongside the policy, which means the benefit is paid to the director's family free from tax.

There are many benefits to Relevant Life Cover compared with personal cover. Obviously, a director's family benefits from knowing that they'll be taken care of financially if the worst should happen thanks to the tax-free insurance payout. This payout can be up to 15 times a director's total remuneration in salary and dividends.

Not Taxing: Relevant Life Tax Benefits

Meanwhile, the company benefits because premiums are eligible for corporation tax relief, potentially lowering the overall tax bill. Note that this is subject to agreement from your local HMRC tax office, but in most cases as the plan forms part of the director's remuneration package it's an allowable business expense.

Some of the biggest savings are for the director themselves, however. As Relevant Life Insurance isn't typically considered a taxable P11D benefit in kind, there's no additional income tax to pay on the premiums for the employee. This is unlike other benefits paid for by the company, such as Private Medical Insurance.

Crucially, if the premiums were paid for outside the company, the director would have to pay out of their own pocket from post-tax income. That means after National Insurance and income/dividend tax have been deducted. Shifting the premiums to the company therefore saves on both of these.

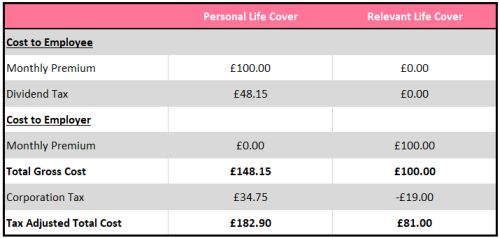

The below table above shows the cost differentiation between a business owner taking out personal Life Insurance and if they were to take out Relevant Life Insurance. In the example below, the business owner pays themselves only a nominal salary with the rest topped up in dividends and they're a higher rate taxpayer. However, you can adjust this to your circumstances by using this Relevant Life Insurance Calculator for the 2017/18 tax year [1].

Ready for Takeup

Despite the tax-efficient nature of Relevant Life Insurance and its benefits to businesses and business owners alike, it remains one of the lesser known insurance products on the UK market today. This is despite major insurers up and down the country offering Relevant Life Insurance and being happy to quote on this basis.

Relevant Life Insurance is readily available, yet takeup remains low.

The issue is chiefly one of awareness among small business owners, who aren't

typically up to speed with the product and its tax efficiencies. Although

company directors sensibly want life cover for their families should the worst

happen, too few know just how beneficial having their limited company own and

pay for the policy can be.

1 - Office for National Statistics, UK Business:

Size, Activity and Location 2017